Description

This month I’m guest posting over on What’s Up Fagans? addressing the question I get asked more than any other as part of my Family Financial Savvy series: “How do I pay my debt?” With total household debt totaling nearly $13 trillion, no family is immune. And the important thing is to be smart about how you do it and know which debt to pay off first.

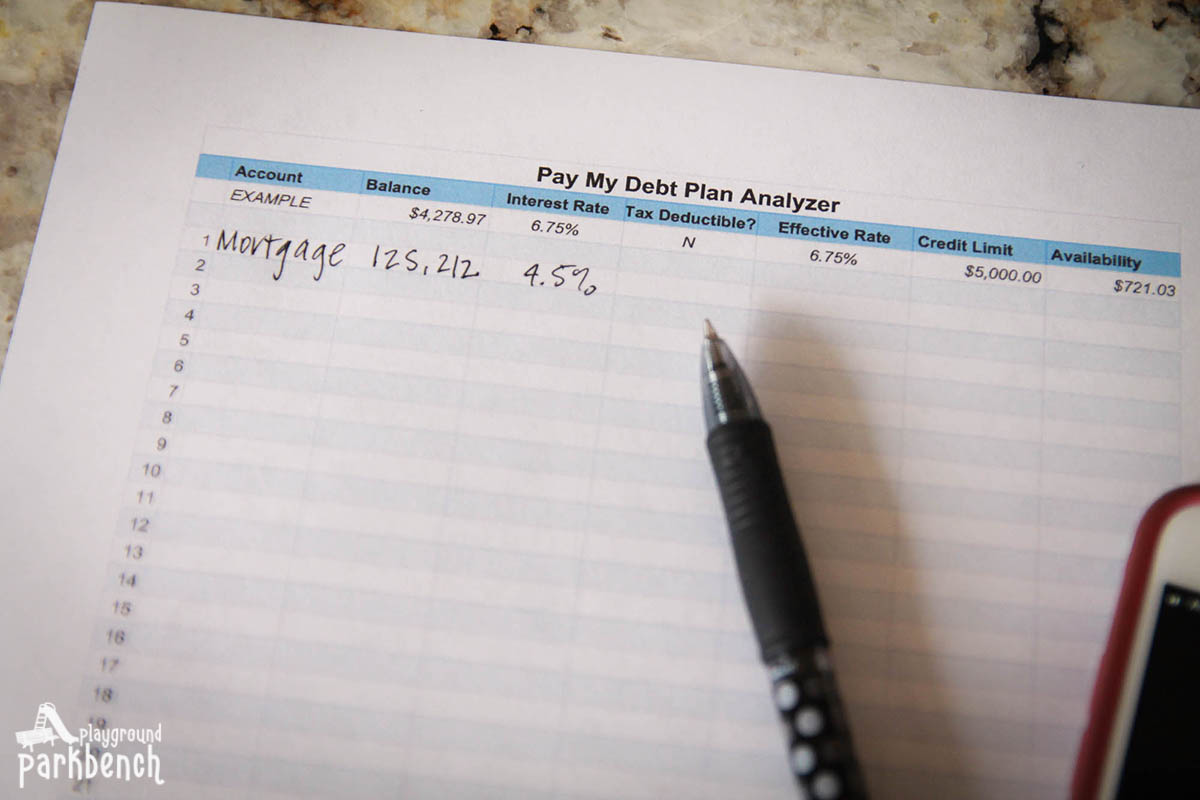

You can check out the full details on exactly how to use this printable spreadsheet over on my guest post: How to Know Which Debt to Pay Off First. To access this printable, simply complete the checkout process (don’t worry, it’s FREE!). On the Order Confirmation screen, you will be given the option to download it as either a PDF or open it up as a Google Sheet.

I highly recommend opening it as a Google Sheet. It is a View-Only file, and to make changes to it, you will need to go to File, Make a copy… Then, save it as your own version and follow the detailed directions at How to Know Which Debt to Pay Off First to create a Pay My Debt Plan!

Outline all your debts outstanding, the interest rates, and credit availability all in one file. Then, use that information to come up with an organized Pay My Debt Plan. Which debt should you pay off first? Can you use existing, lower cost available credit lines to make lump sum pay offs on higher cost debt? Are there lower cost debt options available to you to consolidate higher cost debt and help you pay it off more quickly?

All of these questions are answered in my guest post at What’s Up Fagans?. Checkout to grab your spreadsheet, and visit How to Know Which Debt to Pay Off First to create your own Pay My Debt Plan today.

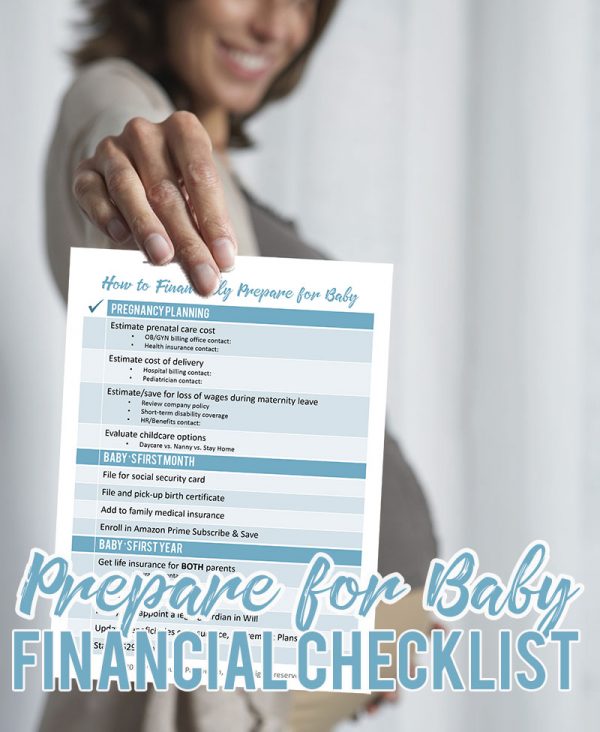

Check out all my Family Financial Savvy tips here, join my private Facebook group: Family Finance Tips for Savvy Mamas, or follow my Family Financial Savvy board on Pinterest.

Love it? PIN THIS!

Reviews

There are no reviews yet.